what is a quarterly tax provision

Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the forecast annual ETR smoothes the tax impact over the full year. Level 2 4 yr.

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

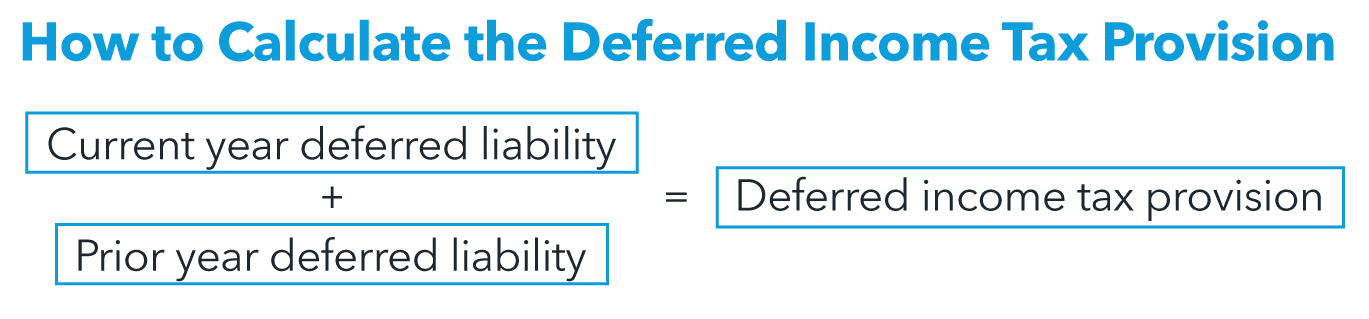

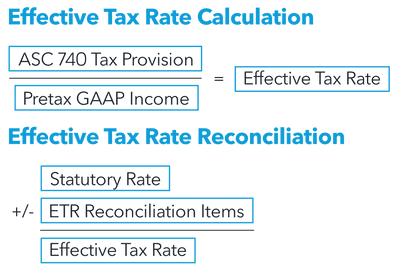

The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year.

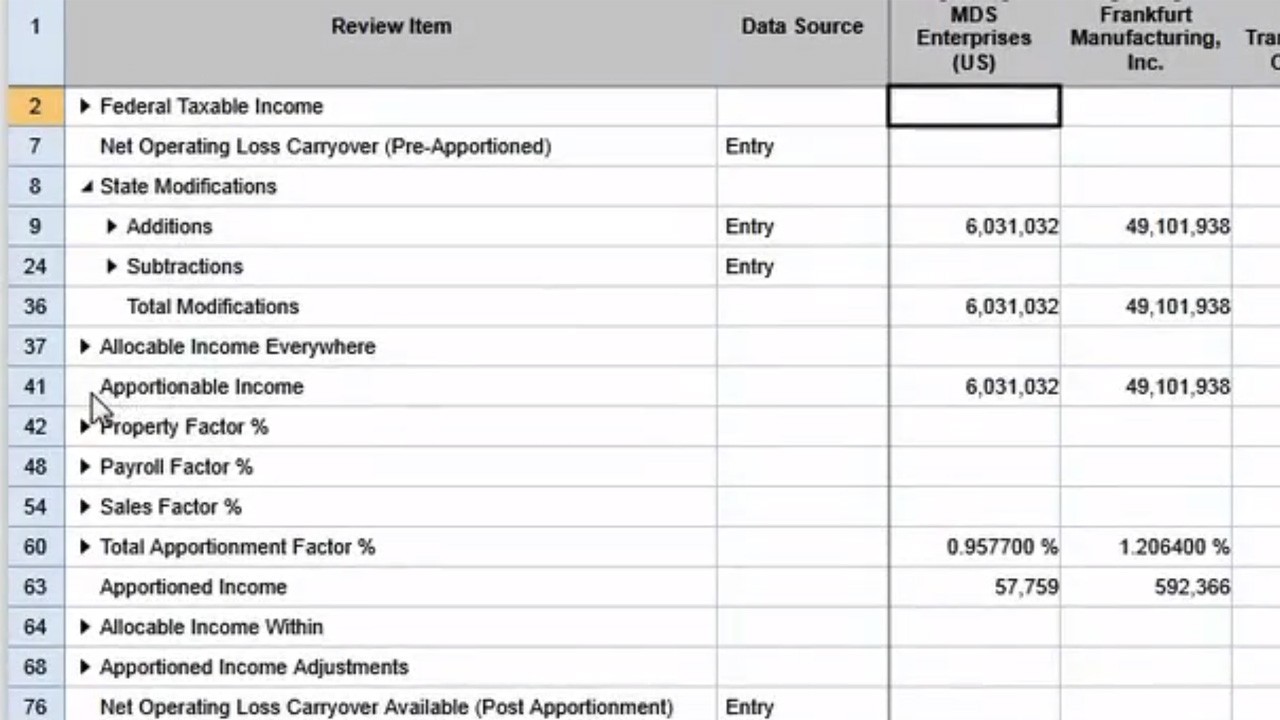

. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. Tax rate changes in the quarter in which the law is effective. A tax rate is generated at the beginning of the year for summary periods such as Quarterly or Yearly.

Provision for Income Tax. For permanent items to the extent the amount estimated at provision is different than the tax return amounts you need to true up the ETR for the. Tax provision is just calculating the estimated tax owed by a businessindividual for the current year.

The amount of this provision is. And if you care about learning planning understanding how it gets reported and. 16343 Interim provisionincome from equity method investments.

Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. Therefore although you may pay taxes annually or quarterly you should do an adjusting entry during each period for which you produce an. A companys current tax expense is based upon current earnings.

The provision can be calculated on a monthly quarterly or annual basis as required. A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense. Yes Im studying AUD right now the company estimates their taxable income for the.

Tax provision is just calculating the estimated tax owed by a businessindividual for the current year. The latest issue of Accounting for Income Taxes. An Administrator or Power User can also create.

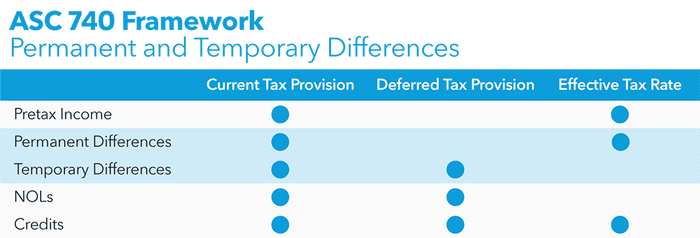

The corporate income tax provision is an important and complex component of the financial statements and related disclosures and it is receiving ever. The provision is the audit part of tax. A tax provision is comprised of two parts.

RTP is return to provision. Typically this is represented quarterly. Tax rate changes in the quarter in which the law is effective.

The provision can be calculated on a monthly. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports.

The provision is the audit part of tax. You do quarterly reviews less substantial in scope than an audit. Calculate the year-to-date tax provision b.

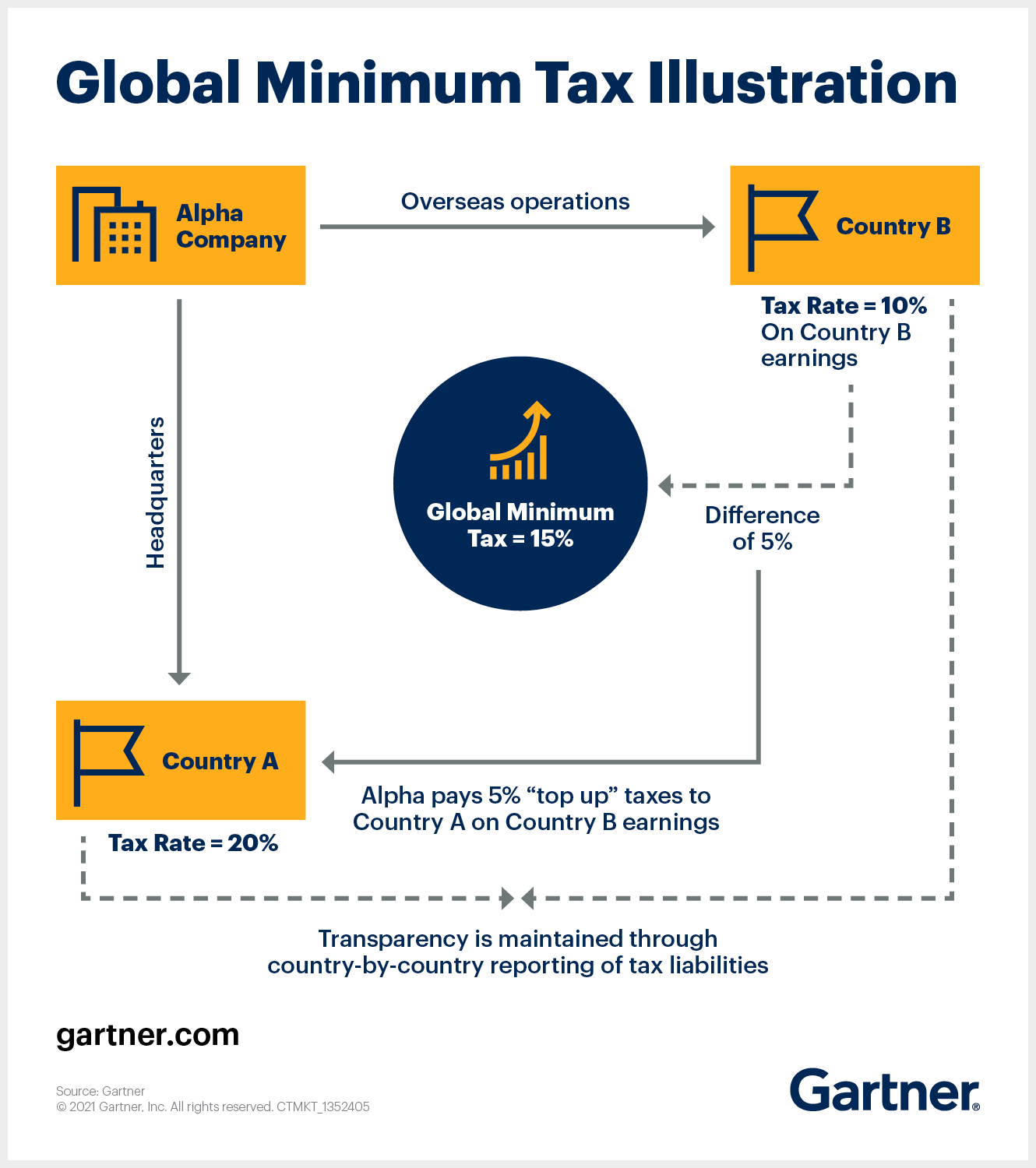

The IRS expects tax payments to be made quarterly to cover income thats been made in the previous three months. I would say provision is a lot more complex and challenging at the MNC F500 level. Negative ETR due to withholding taxes orand naked credit tax effects Jurisdictions for which a reliable estimate cannot be made Exception Two Recognize a tax expense benefit for the.

Recent editions appear below. Interim Tax Provisioning Overview. Assume no discrete items and the following quarterly information.

It is typically appropriate to record an investors equity in the net income of a 50 or-less owned investee on an after-tax. Of course now forms 10-K and 10-Q are annual and quarterly reports that tell us about who a company is and how theyve been doing and part of the reports is the provision for income tax. The amount of this provision is derived by adjusting the firms reported net.

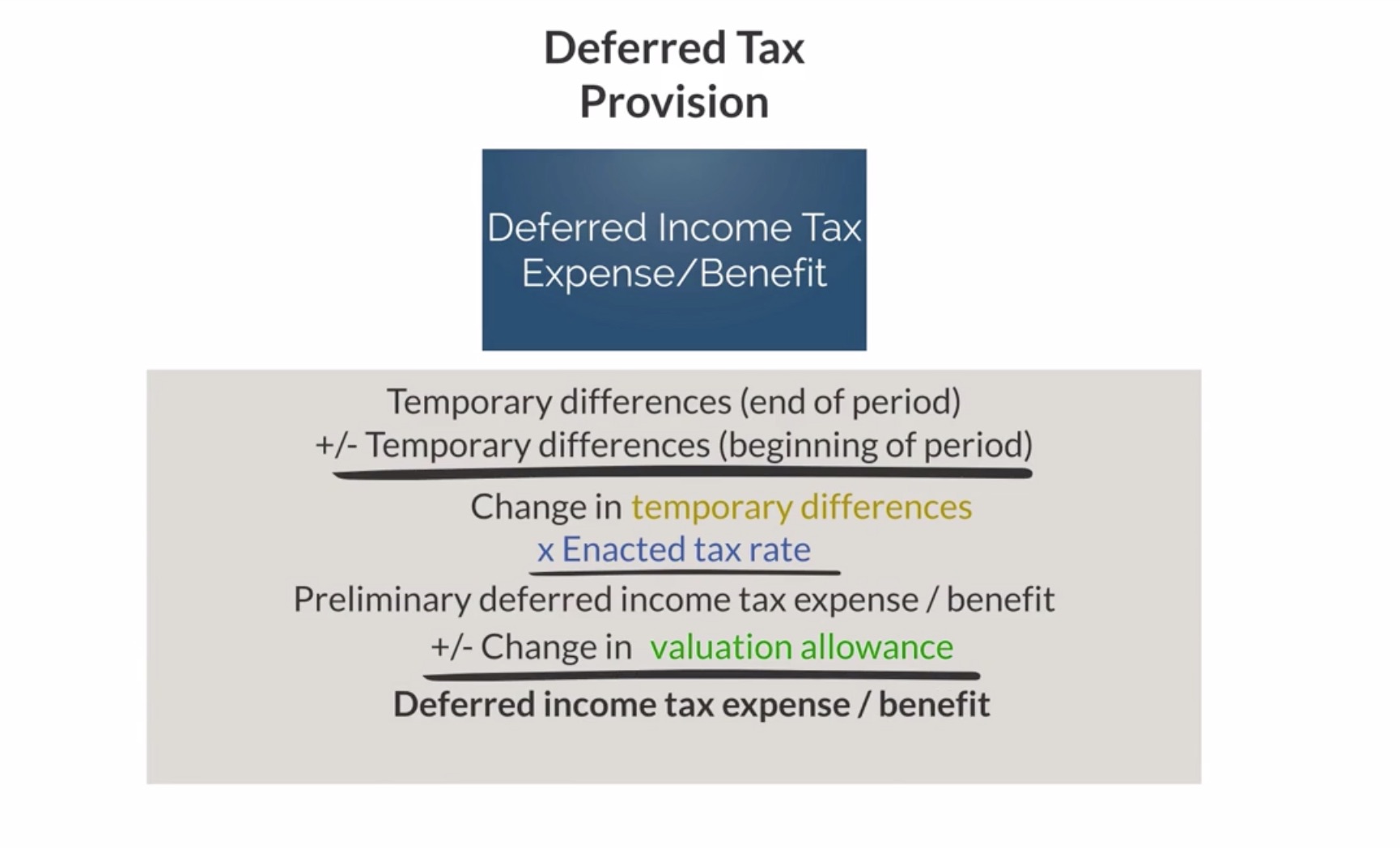

In normal years these are the due dates. Current income tax expense and deferred income tax expense. Calculate the quarterly tax provision c.

You do this a lot for financial statement purposes. Efficiently and accurately address the entire range of complex ASC 740 technical topics. Simplify your ASC 740 process with Bloomberg Tax Provision a corporate tax provision software.

Annual ETR applied to YTD. Annual ETR applied to YTD income plus discreet tax items make up the quarterly annual tax expense.

Changes To Accounting For Employee Share Based Payment The Cpa Journal

Key Actions For Tax Leaders On Global Minimum Tax

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Estimated Tax Payments Software By Thomson Reuters Onesource

Fin 48 Compliance Disclosing Tax Positions In An Age Of Uncertainty

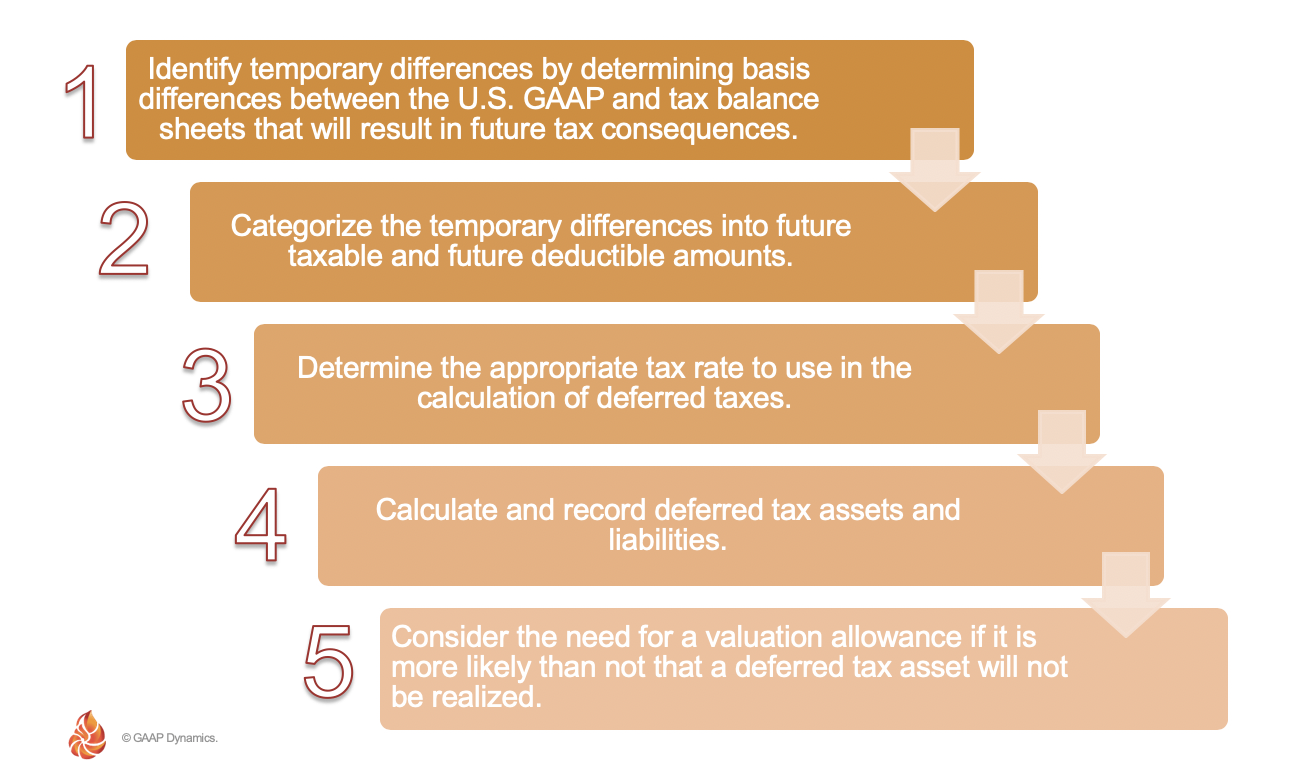

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

2020 Deferred Tax Provision Covid 19 Grant Thornton

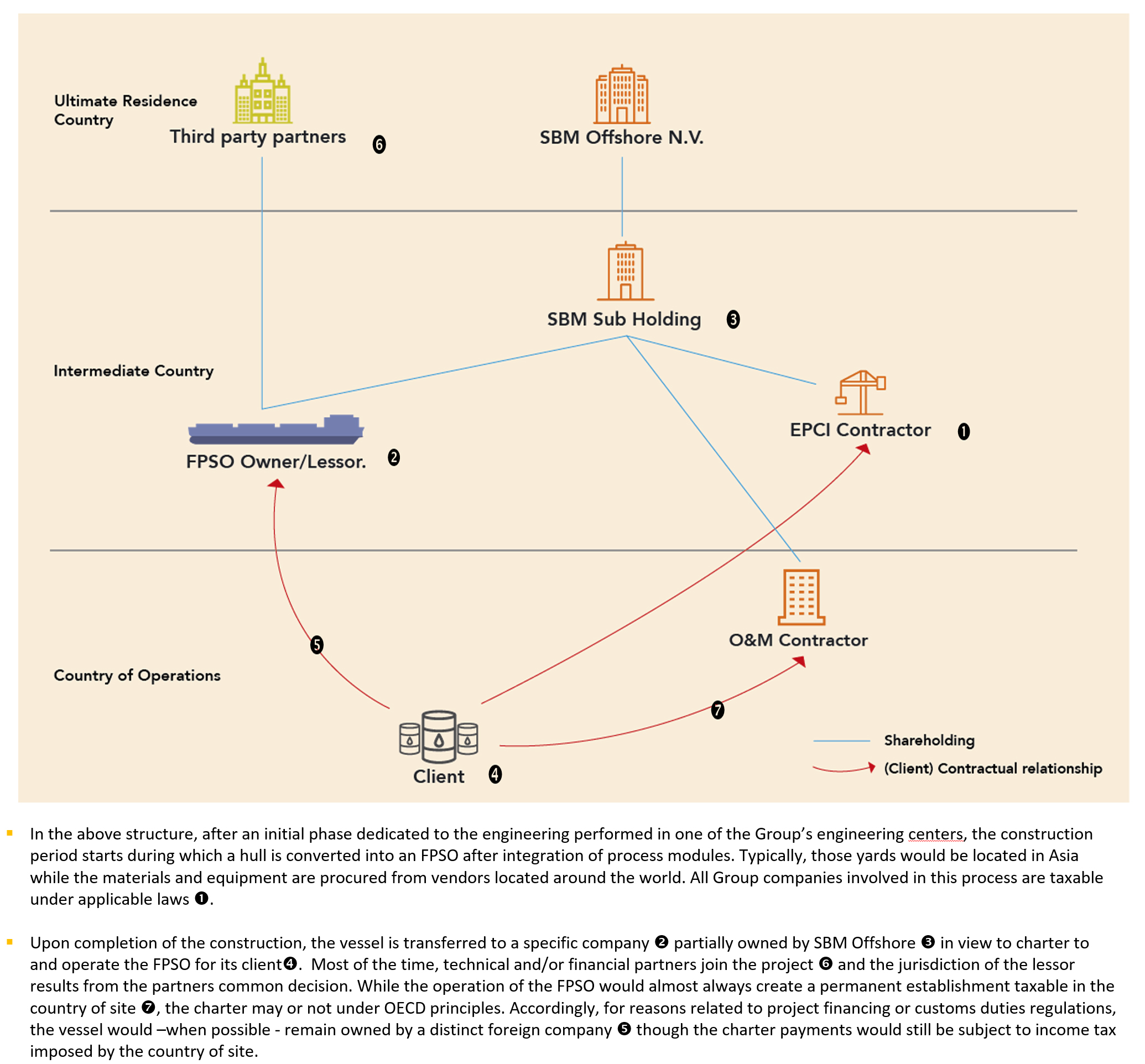

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

The Income Tax Provision Crossborder Solutions

Fin 48 Compliance Disclosing Tax Positions In An Age Of Uncertainty

Provision For Income Tax Definition Formula Calculation Examples

Tax Accounting Provisions Perspectives Analysis And News Deloitte Us

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Provision For Income Tax Definition Formula Calculation Examples